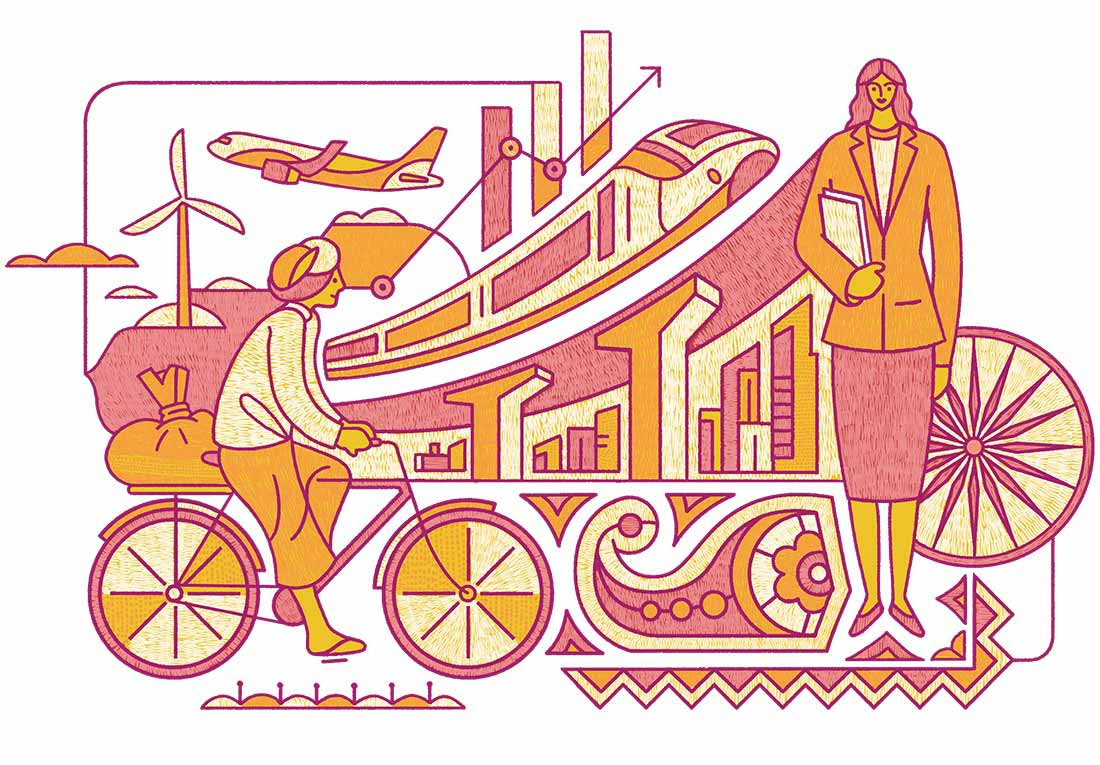

India in Transition

India in Transition (IiT) is a publication that presents brief, analytical perspectives to a wide and diverse audience on innovative ideas and ongoing transformations in contemporary India.

Jawaharlal Nehru still looms large over India. The ideas and ideology of the country’s first prime minister continue to shape debates about its past and future.

India in Transition (IiT) is published by the Center for the Advanced Study of India (CASI) of the University of Pennsylvania. All viewpoints, positions, and conclusions expressed in IiT are solely those of the author(s) and not specifically those of CASI.