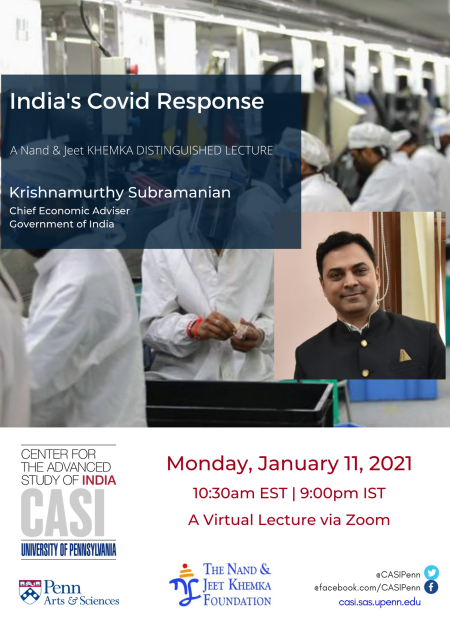

Krishnamurthy Subramanian

Dr. Krishnamurthy Subramanian, currently the Chief Economic Adviser to the Government of India, is a leading expert on economic policy, banking and corporate governance. In his role as Chief Economic Adviser, he has authored India’s 2019 Economic Survey and 2020 Economic Survey, the flagship annual document of the Ministry of Finance. His academic articles span various topics, including corporate governance, bankruptcy, and banking deregulation, and have appeared in a range of peer-reviewed journals including Journal of Financial Economics, Review of Financial Studies, and Journal of Law and Economics. He has previously served on several expert committees including the P.J. Nayak Committee on governance of banks for the Reserve Bank of India and the Uday Kotak Corporate Governance Committee of Securities and Exchange Board of India. He was also the Founding Board Member at Bandhan Bank (2015-18).

Dr. Subramanian earned a Ph.D. from Chicago-Booth, a B.Tech in Electrical Engineering from IIT Kanpur, and a PGDM from IIM Calcutta, where he was placed in the Honor Roll for his top-ranking performance. At the University of Chicago, he was awarded the Ewing Marion Kauffman Foundation Dissertation Fellowship—an award given to top 20 Ph.D. dissertations across all disciplines. He is on leave from the Indian School of Business, where he is a Professor of Finance. Dr. Subramanian has previously been an Assistant Professor of Finance at Emory University and has worked with leading financial firms such as ICICI and J. P. Morgan Chase.